2020.12.11 Update on the Next Round of COVID Relief

The EACA conducted a live webinar on Friday, December 11 to review negotiations in Congress for the Next Round of COVID Relief for employers and employees that have been devastated by the COVID pandemic. As you may recall, the Payroll Protection Program (PPP) was originally signed into law on March 27 as part of the […]

The EACA conducted a live webinar on Friday, December 11 to review negotiations in Congress for the Next Round of COVID Relief for employers and employees that have been devastated by the COVID pandemic.

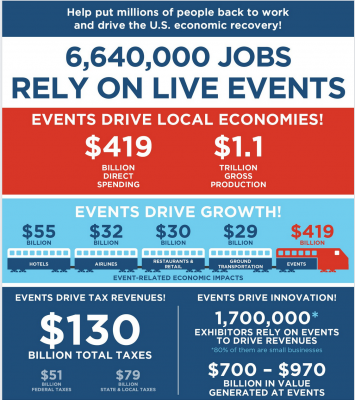

As you may recall, the Payroll Protection Program (PPP) was originally signed into law on March 27 as part of the CARES Act. PPP provided forgive-able loans from the SBA which companies could uses for payroll and certain overhead expenses during business shutdowns caused by the pandemic. On Friday, June 5 the Payroll Protection Program Flexibility Act was signed into law to extend some of the benefits of the original legislation as the pandemic raged on longer than anticipate.

While there was hope that a second round of stimulus would be passed in August the political realities of an election year made that impossible. Now that the election has passed, Congress finally seems willing to recognize that those companies that have been most severely impacted by the pandemic need additional relief to survive. Today’s program will review all aspects of the most recent discussions regarding provisions of the new COVID relief legislation with Tim Heffernan of T3 Expo and Kevin Binger of Cassidy & Associates who have been directly involved in the crafting of the legislation and who have much of the inside information as to what updates and changes are in store. We are also pleased to welcome Chris Griffin of Crew XP to the conversation, having recently been recognized at EDPA ACCESS as their Ambassador of the Year for his efforts in advocating for their members and our industry in general.